A hidden drain on the American healthcare system isn’t always found in the operating room or the research lab; it often lurks within the intricate gears of the revenue cycle. While complex administration has long been a known issue, recent data paints a stark picture: these complexities cost the U.S. healthcare system an estimated $265 billion annually—a sum larger than the GDP of many nations. This staggering figure, part of a total administrative spend that accounts for up to 40% of all healthcare expenditures, underscores a critical challenge: friction in the revenue cycle is not merely an inconvenience; it’s a colossal financial burden impacting every facet of patient care and organizational sustainability.

Imagine Sarah, a busy mother, receiving a complex, jargon-filled medical bill months after her procedure. She struggles to understand what she owes, whom to call, and why her insurance didn’t cover more. This frustration isn’t an isolated incident; it’s a symptom of a system bogged down by friction, leading to delayed payments, increased administrative costs, and eroding patient trust.

A “frictionless” revenue cycle, in modern healthcare, signifies the seamless, accurate, and transparent flow of data and financial information. From the moment a patient schedules an appointment to the final payment, every touchpoint should be optimized for efficiency and clarity. It’s about more than just processing claims; it’s about creating an intelligent ecosystem where data flows effortlessly, errors are proactively prevented, and financial interactions are as smooth as the clinical ones. The bottom-line impact is profound: every percentage point gained in first-pass claim acceptance can translate to millions in recovered revenue and reduced labor costs for an average health system.

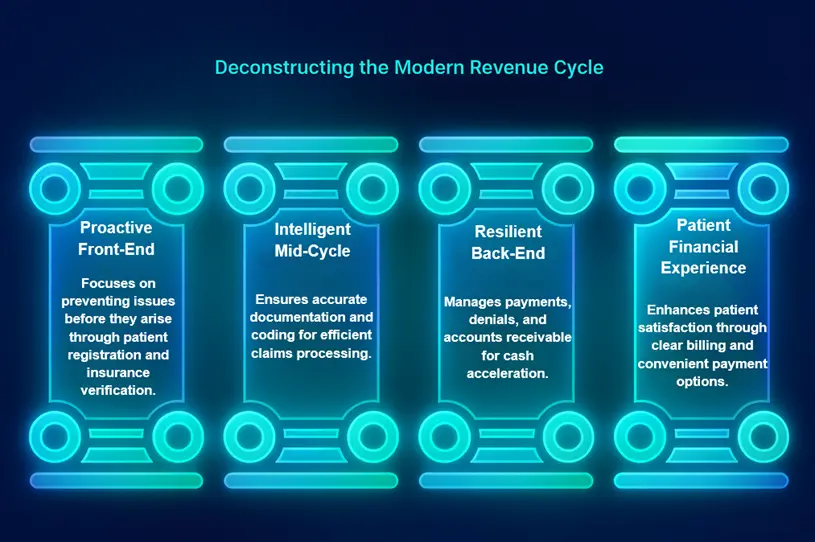

Deconstructing the Modern Revenue Cycle: A Four-Pillar Framework

Achieving a frictionless revenue cycle requires a strategic approach, built upon four interdependent pillars that address the entire patient financial journey.

Pillar 1: The Proactive Front-End (Denial Prevention)

The journey to a healthy revenue cycle begins long before a service is rendered. The front-end is your primary defense against costly downstream issues.

-

Patient Registration & Scheduling: The Cost of a Single Error Consider the seemingly innocuous error of an incorrect insurance ID entered during patient registration. This single typo doesn’t just hold up a claim; it triggers a cascade of manual interventions. The claim is denied. Your billing team spends hours tracking down the correct information and resubmitting. A recent survey revealed that the average cost to rework a single denied claim ranges from $25 to as high as $117. Multiplied across thousands of claims, this becomes a significant financial drain.

-

Insurance Verification & Prior Authorization: Critical Checkpoint This isn’t merely a formality; it’s the single most critical denial prevention checkpoint. Modern healthcare systems are deploying AI-powered, real-time verification tools. These tools don’t just confirm eligibility; they delve into specific plan coverage for the intended procedure, flagging potential issues (e.g., “this plan requires prior authorization for an MRI”) before the patient even arrives. This proactive intelligence directly combats a leading cause of denials. Strikingly, over 80% of prior authorization denials that are appealed are ultimately overturned, proving the initial rejections were often preventable.

-

Price Transparency & Patient Counseling: A Revenue Generator When patients understand their financial responsibility upfront, they are far more likely to pay. Offering clear, itemized estimates at the point of service, coupled with empathetic financial counseling, transforms a potential collection headache into a predictable revenue stream. This is especially crucial as patient collection rates for insured individuals have declined to just 34.4%. Systems that excel in upfront communication see patient self-pay collections increase by 15-20%.

Pillar 2: The Intelligent Mid-Cycle (Accuracy Engine)

Once care is delivered, the mid-cycle ensures that every service provided is accurately documented and translated into a billable claim.

-

Clinical Documentation & Charge Capture: Linking Care to Reimbursement The details matter. A physician’s note stating “patient experienced shortness of breath” versus “patient experienced acute exacerbation of chronic obstructive pulmonary disease (COPD)” carries vastly different reimbursement implications. A poorly documented comorbidity or an incomplete procedure note can lead to significant underpayment or outright denial.

-

Medical Coding & Claims Submission: AI-Powered Augmentation The complexity of medical coding is escalating. Forward-thinking organizations are leveraging AI-powered suggestive coding. These systems analyze unstructured clinical notes and lab results to propose highly accurate codes, reducing human error. This isn’t about replacing human coders but augmenting their capabilities, allowing them to focus on complex cases while AI handles high-volume tasks.

-

Clean Claims & First-Pass Resolution: The Ultimate KPI The clean claim rate is the ultimate metric of a healthy mid-cycle. While the national average hovers between 75-85%, world-class organizations aim for 98% or higher. Bridging this gap requires rigorous pre-submission claim scrubbing, where sophisticated algorithms automatically identify and correct errors before they ever reach the payer.

Pillar 3: The Resilient Back-End (Cash Acceleration)

Even with robust front and mid-cycle processes, the back-end is crucial for efficient cash recovery and agile problem-solving.

-

Payment Posting & Reconciliation: Immediate Underpayment Flags Manual payment posting is a bottleneck. Automated, line-item level posting immediately flags discrepancies. If a payer reimburses $80 for a service where the expected payment was $100, the system flags it for review within minutes, not days. This speed significantly reduces the industry average of 14-30 days to identify underpayments.

-

Denial Management & Appeals: Eliminating Root Causes The goal isn’t just to manage denials; it’s to eliminate their root causes. With initial denial rates climbing to nearly 12-15% for many providers, a reactive approach is unsustainable. AI-powered analytics can process vast amounts of denial data to pinpoint systemic issues, transforming denial management from a reactive chore into a proactive improvement engine.

-

Accounts Receivable (A/R) Follow-Up: AI-Driven Prioritization Traditional A/R follow-up involves staff sifting through aged claims. AI-driven prioritization allows staff to focus on claims most likely to be recovered. For example, an AI might identify that claims over $5,000 from a specific payer, between 60-90 days old, have an 80% chance of recovery with a targeted follow-up, potentially reducing average days in A/R by 10-20%.

Pillar 4: The Patient Financial Experience (Loyalty Multiplier)

A truly frictionless revenue cycle extends beyond internal operations to redefine the patient’s financial journey, fostering loyalty and positive engagement.

-

Patient-Friendly Billing & Statements: Retail Simplicity Modern systems are adopting retail-like billing summaries—simple, clear, and easy to understand. Instead of dense codes, they provide a plain-language breakdown of services, insurance payments, and patient responsibility, significantly reducing calls to billing departments.

-

Modern Payment Options: Convenience at Their Fingertips Offering flexible payment plans, secure online portals, and communication via text message aligns with consumer expectations. The easier it is for patients to pay, the faster revenue flows in.

-

Empathetic Patient Support: First-Call Resolution Equipping support staff with a unified view of the patient’s record is paramount. This allows them to resolve issues on the first call, boosting patient satisfaction and accelerating collections.

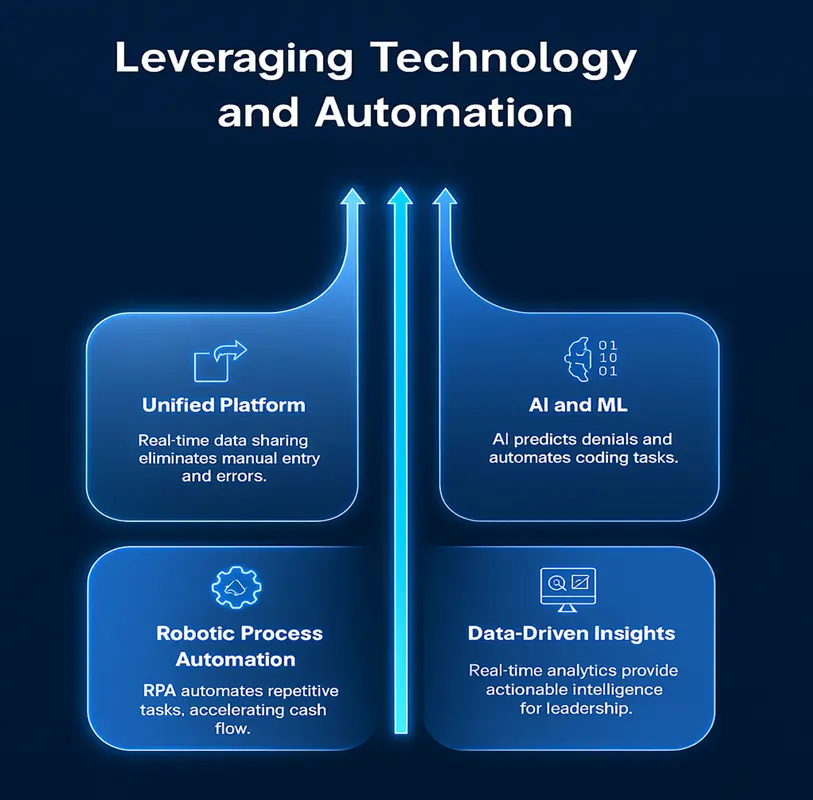

The Friction-Fighting Toolkit: Leveraging Technology and Automation

The aspiration for a frictionless revenue cycle is realized through the intelligent application of technology.

- The Power of a Unified Platform: Breaking down data silos is foundational. When an Electronic Health Record (EHR) and an RCM system share data in real-time, the benefits are tangible. This unification eliminates manual data entry, reduces errors, and provides a holistic view of each patient’s journey.

- Artificial Intelligence (AI) and Machine Learning (ML): AI can analyze historical data to flag a claim as “high-risk for denial” before submission. It also assists human coders by automating the coding of high-volume, low-complexity cases.

- Robotic Process Automation (RPA): RPA tackles repetitive, rule-based tasks with incredible efficiency. RPA bots can check hundreds of claim statuses on various payer portals in the time it takes a human to check a few, accelerating cash flow.

- Data-Driven Insights: Technology provides the critical feedback loop. Tracking KPIs like clean claim rates and denial rates by payer helps identify bottlenecks. Advanced analytics dashboards provide these insights in real-time, empowering leadership with actionable intelligence.

Building a Culture of Collaboration: Breaking Down Silos

Technology is a powerful enabler, but a frictionless revenue cycle also demands a fundamental shift in organizational culture.

- The Clinical and Financial Connection: RCM teams must evolve into strategic partners with clinical staff, providing feedback that helps clinicians understand the financial impact of their documentation.

- Cross-Departmental Communication: Silos are friction factories. A monthly “Denial Review” meeting, attended by leaders from Patient Access, Clinical Departments, and Billing, helps identify root causes and develop collaborative solutions.

- Continuous Staff Training and Development: Payer rules are constantly evolving. Staff across the revenue cycle need ongoing education on how new policies, coding updates, and compliance requirements impact their roles.

The Future is Frictionless: Key Takeaways and Actionable Next Steps

The blueprint for a frictionless revenue cycle rests on four interconnected pillars: a proactive front-end, an intelligent mid-cycle, a resilient back-end, and an empathetic patient financial experience. Technology serves as the indispensable toolkit, while a culture of collaboration forms the bedrock.

Embracing a frictionless revenue cycle is more than a financial optimization strategy; it’s a competitive advantage. It frees up resources, reduces administrative burden, and ultimately enables healthcare organizations to reinvest in their core mission: delivering exceptional patient care.

Your Actionable Next Steps:

We challenge you to embark on your own “friction audit.” Identify the single biggest point of friction in your:

- Front-End: Is it patient registration errors, insurance verification delays, or unclear price estimates?

- Mid-Cycle: Are there persistent issues with clinical documentation, coding accuracy, or clean claim rates?

- Back-End: Are you struggling with slow payment posting, ineffective denial management, or inefficient A/R follow-up?

For each identified point, brainstorm one tangible improvement. This exercise is the first step toward transforming your revenue cycle from a source of financial drain into a powerful engine of sustainable growth.